Your credit score plays a big role in your financial life—even if you don’t realize it yet. Whether you’re applying for a credit card, renting an apartment, buying a car, or getting a mortgage, your credit score can decide yes or no, and how much interest you’ll pay.

What Is a Credit Score?

A credit score is a three-digit number that shows lenders how trustworthy you are when it comes to borrowing money. It tells banks and lenders how likely you are to repay what you borrow.

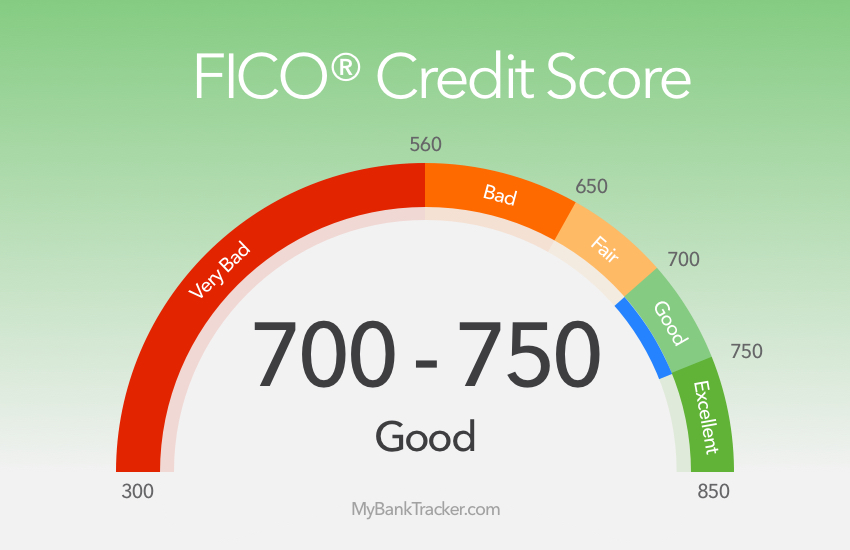

In the U.S., most credit scores range from 300 to 850. The higher your score, the better you look to lenders.

(Experian)

Think of your credit score like a financial report card—it summarizes how responsibly you handle credit.

Credit Score Ranges Explained

Here’s how credit scores are usually categorized:

- 300–579 → Poor

- 580–669 → Fair

- 670–739 → Good

- 740–799 → Very Good

- 800–850 → Excellent

A score of 670 or higher is generally considered good and can help you qualify for better interest rates.

(MyFICO)

What Affects Your Credit Score?

Your credit score is calculated using information from your credit report. Here are the five main factors that affect it:

1️⃣ Payment History (35%)

This is the most important factor. It shows whether you pay your bills on time. Late or missed payments can seriously hurt your score.

(Experian)

✔ Tip: Always pay at least the minimum amount due—on time.

2️⃣ Credit Utilization (30%)

This measures how much of your available credit you’re using.

Example:

If your credit limit is $10,000 and you’ve used $3,000, your utilization is 30%.

Experts recommend keeping utilization below 30%.

(NerdWallet)

3️⃣ Length of Credit History (15%)

This looks at how long you’ve had credit accounts. Older accounts help your score because they show a longer borrowing history.

✔ Tip: Don’t close old credit cards unless necessary.

4️⃣ Credit Mix (10%)

Lenders like to see different types of credit, such as:

- Credit cards

- Auto loans

- Student loans

- Mortgages

A healthy mix shows you can manage different kinds of debt.

(Equifax)

5️⃣ New Credit (10%)

Applying for many new credit accounts in a short time can lower your score. Each application usually causes a hard inquiry, which may temporarily reduce your score.

(Consumer Financial Protection Bureau)

Why Credit Scores Matter

Your credit score affects more than just loans:

- Lower interest rates on credit cards and loans

- Better chances of approval for rentals and mortgages

- Lower insurance premiums in some states

- Easier utility and phone service approvals

A higher credit score can save you thousands of dollars over time.

(CFPB)

Credit Score vs. Credit Report

Many people confuse these two, but they’re different:

- Credit Report → A detailed history of your credit accounts

- Credit Score → A number calculated from that report

You can check your credit report for free once a year at:

👉 https://www.annualcreditreport.com

(Annual Credit Report)

How to Build or Improve Your Credit Score

Here are simple, proven ways to improve your score:

✅ Pay Bills on Time

Set up automatic payments or reminders to avoid late payments.

✅ Keep Credit Card Balances Low

Try to pay off your balance in full each month if possible.

✅ Avoid Unnecessary Credit Applications

Only apply for credit when you really need it.

✅ Monitor Your Credit Report

Check for errors and dispute incorrect information.

(FTC)

✅ Be Patient

Credit scores improve over time with consistent, responsible habits.

Common Credit Score Myths

Myth 1: Checking your credit hurts your score

➡ False. Checking your own credit is a soft inquiry and does not affect your score.

(Experian)

Myth 2: You need debt to build credit

➡ Not true. Responsible use of credit—not debt—is what matters.

Myth 3: Closing credit cards helps your score

➡ Often false. Closing cards can increase utilization and lower your score.

Credit Scores Are a Long-Term Game

Improving your credit score doesn’t happen overnight—and that’s okay. What matters is consistent, healthy habits. Even small steps, like paying one bill on time every month, make a difference over time.

Think of your credit score as a reflection of your financial behavior—not your worth. With patience and smart choices, anyone can build strong credit.