Building credit fast is one of the most common financial goals today—and for good reason. A good credit score can help you get approved for loans, rent an apartment, buy a car, and even lower your insurance costs. But if you’re starting from zero (or recovering from bad credit), it can feel confusing and frustrating.

The good news? You can build credit fast if you follow the right steps consistently. In this guide, we’ll break everything down in simple words, explain why each step works, and show you how to avoid common mistakes—no financial jargon, no unrealistic promises.

What Is Credit and Why Does It Matter?

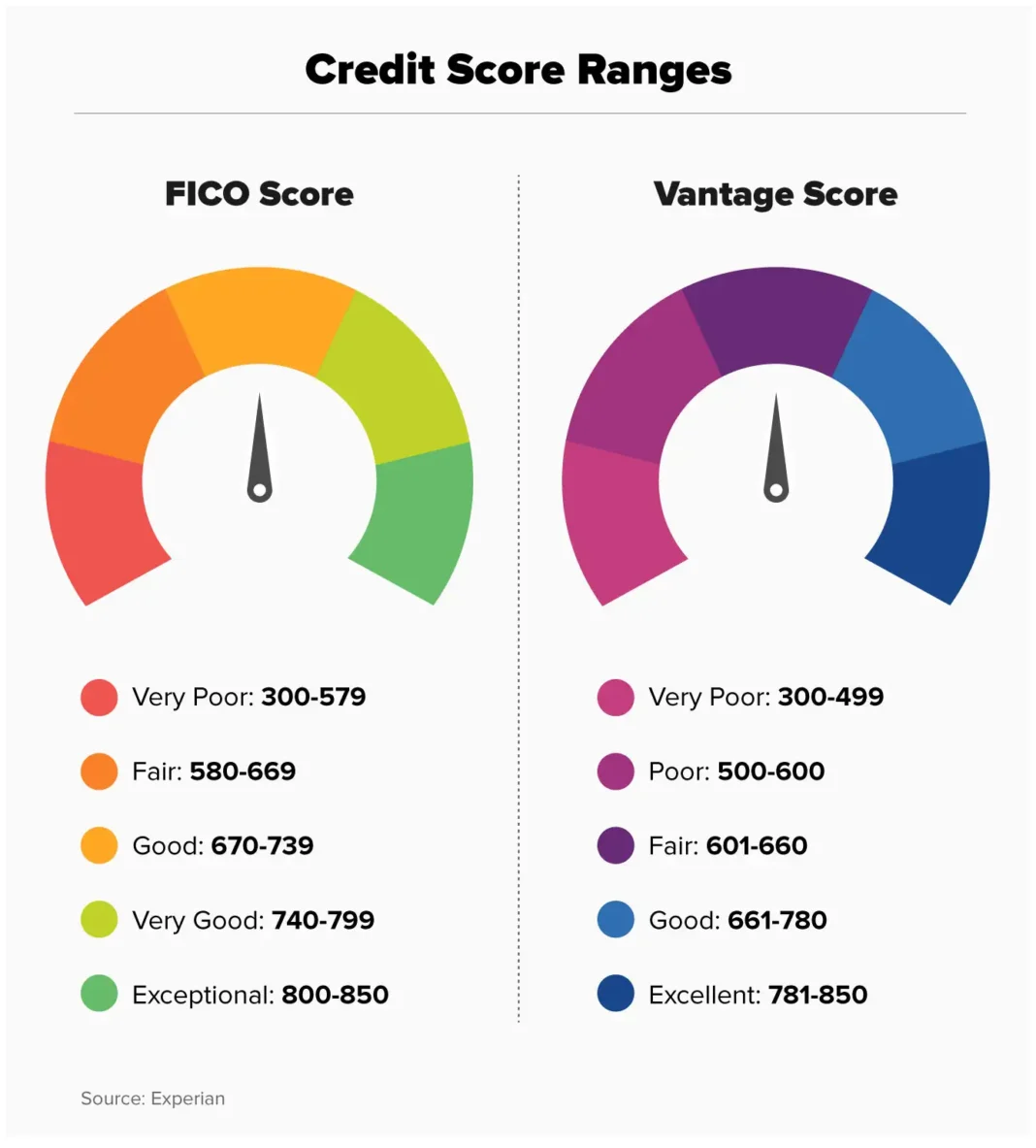

Your credit score is a number that shows lenders how responsible you are with borrowed money. In the U.S., most scores range from 300 to 850. The higher your score, the better your chances of approval and lower interest rates.

Credit scores are mainly based on:

- Payment history

- Credit utilization (how much you use)

- Length of credit history

- Credit mix

- New credit inquiries

Understanding these factors is key to building credit quickly.

1. Get a Credit Card (The Right Way)

If you don’t have any credit, the fastest way to start is by opening a starter credit card.

Best options:

- Secured credit cards (you put down a deposit)

- Student credit cards

- Beginner unsecured cards

These cards are designed for people with little or no credit history. When used responsibly, they report your activity to credit bureaus and help build your score.

👉 Keep your credit limit low and manageable.

2. Always Pay On Time (This Matters Most)

Payment history makes up about 35% of your credit score, making it the single most important factor.

Even one late payment can hurt your score and slow down progress.

Easy tips:

- Set up automatic payments

- Pay at least the minimum due

- Pay a few days early if possible

On-time payments show lenders you’re reliable—and that builds trust fast.

3. Keep Your Credit Use Very Low

This is one of the fastest ways to boost your score.

Credit utilization means how much of your available credit you’re using. Experts recommend staying below 30%, but under 10% is even better for fast results.

Example:

If your credit limit is $500:

- 30% use = $150

- 10% use = $50

Low usage tells lenders you’re not dependent on credit.

4. Become an Authorized User

This is a credit-building shortcut many people overlook.

If a trusted family member or friend adds you as an authorized user on their credit card, their positive history can appear on your credit report—even if you never use the card.

⚠️ Make sure:

- The account has on-time payments

- The balance is low

- The card issuer reports authorized users

5. Check Your Credit Report for Errors

Mistakes on credit reports are more common than you think—and they can hold your score down.

You can get free credit reports from all three bureaus once a year at:

👉 https://www.annualcreditreport.com

Look for:

- Accounts that aren’t yours

- Incorrect late payments

- Wrong balances

Disputing errors can improve your score faster than any new account.

6. Don’t Open Too Many Accounts at Once

Each credit application causes a hard inquiry, which can slightly lower your score temporarily. Opening too many accounts too fast sends a red flag to lenders.

👉 Space out applications by at least 3–6 months.

7. Be Consistent (This Is Where Most People Fail)

There’s no overnight miracle—but there is fast progress if you’re consistent.

With good habits, many people see improvements in 3–6 months.

Consistency beats perfection every time.

Common Credit-Building Mistakes to Avoid

Avoid these if you want fast results:

- Maxing out your card

- Missing payments

- Closing old accounts too soon

- Ignoring your credit report

- Paying only once a month (bi-weekly payments can help)

Final Thoughts: You Can Build Credit Fast

Building credit fast isn’t about tricks—it’s about smart habits done consistently. Start with one card, pay on time, keep balances low, and monitor your credit regularly.

If you stay disciplined, your credit score will grow—and so will your financial freedom.