Understanding your credit score can feel like decoding a secret language. But good news — it doesn’t have to be complicated. Whether you’re planning to buy a home, lease a car, or simply understand where you stand financially, knowing what a good credit score looks like is essential. In this guide, we break it down with ranges, charts, and clear examples, so you can take action with confidence.

What Is a Credit Score?

A credit score is a three‑digit number that reflects your creditworthiness — essentially how likely you are to repay borrowed money. Lenders use it to decide whether to lend to you, how much to lend, and at what interest rate.

The most commonly used credit score model in the U.S. is the FICO Score, which ranges from 300 to 850. Another popular model is the VantageScore, which also uses a similar range.

👉 Learn more about how credit scores are calculated from FICO: https://www.myfico.com/credit‑education/credit‑scores

Credit Score Ranges (FICO & VantageScore)

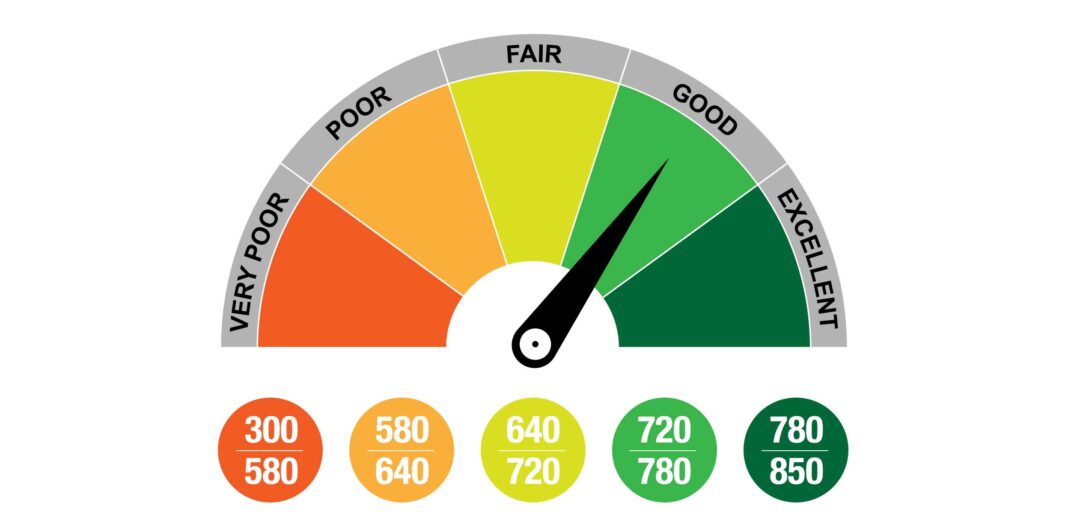

Below is a summary of credit score ranges and what they generally mean:

| Credit Score Range | Category | Meaning |

|---|---|---|

| 800 – 850 | Exceptional | Excellent credit, best rates & approval odds |

| 740 – 799 | Very Good | Strong credit, attractive loan options |

| 670 – 739 | Good | Solid credit, qualifies for most loans |

| 580 – 669 | Fair | Some risk, higher interest rates |

| 300 – 579 | Poor | Difficulty getting approved without co‑signer |

FICO vs. VantageScore

While the score ranges are similar, the criteria and weighting may differ slightly. VantageScore emphasizes recent credit behavior more than older history.

Explore how VantageScore works here: https://your.vantagescore.com/learn/whats‑a‑good‑credit‑score

What Is Considered a Good Credit Score?

In most lending decisions, a good credit score starts at 670 on the FICO scale. Here’s why:

- 670–739 (Good): This range indicates reliable repayment behavior. Most lenders are comfortable offering standard loans and credit cards in this category.

- 740–799 (Very Good): You’ll likely get better interest rates and borrowing terms.

- 800+ (Exceptional): This is the gold standard — you’ll qualify for the best rates and premium financial products.

Why Your Credit Score Matters

Your credit score affects more than just loan approvals. It can impact:

- 📉 Interest rates – Lower scores may mean higher costs over time.

- 🏡 Mortgage approvals – Many lenders require good/excellent scores for favorable home loan terms.

- 🚗 Auto financing – Better scores often secure lower monthly payments.

- 💼 Job opportunities – Some employers check credit as part of hiring.

- 🏠 Renting an apartment – Landlords often evaluate credit history.

Examples: Real‑World Credit Score Scenarios

Here are a few realistic examples to help you see how scores translate into lending decisions:

Scenario 1: First‑Time Borrower, Score = 690

- Category: Good

- Loan Outcome: Likely approved for a car loan with decent APR

- Next Step: Continue on‑time payments to reach Very Good range

Scenario 2: Score = 750

- Category: Very Good

- Outcome: Excellent student or personal loan options, lower interest offers

- Tip: Keep using credit responsibly to maintain or improve score

Scenario 3: Score = 580

- Category: Fair

- Outcome: May need a co‑signer or secured card to improve credit

- Action Plan: Focus on payments and credit utilization

How to Improve Your Credit Score

Improving your credit score doesn’t happen overnight, but smart habits make a difference:

✅ Pay bills on time — Payment history is the biggest factor.

✅ Keep balances low — Credit utilization should stay below 30%.

✅ Avoid opening too many accounts at once — New credit can hurt short‑term scoring.

✅ Check your credit report regularly — Identify errors early.

✅ Diversify credit types — A mix of installment and revolving credit can help.

For free annual credit reports, visit AnnualCreditReport.com: https://www.annualcreditreport.com

Bottom Line

A good credit score gives you financial power — it opens doors to lower interest rates, better loan terms, and more financial flexibility. Most lenders view scores 670 and above as favorable, with scores above 740 earning the best lending terms.

Whether you’re just starting out or working to improve your score, understanding where you fall on the credit spectrum is the first step toward stronger financial health.